By Sarah Billingsley, Communications Director

One of our favorite things is to receive a RFP (Request for Proposal) for AWN publications. Ad sellers often receive requests for rates, specs, and deadlines, but also for specific demographic and circulation information. Advertisers ask for basic demos (such as gender, age and income) and age breakdowns are particularly important to liquor and tobacco categories. Advertisers consistently stress the need for third-party research.

So, what are the options when syndicated research auditing services are cost prohibitive, or your product or market is not covered?

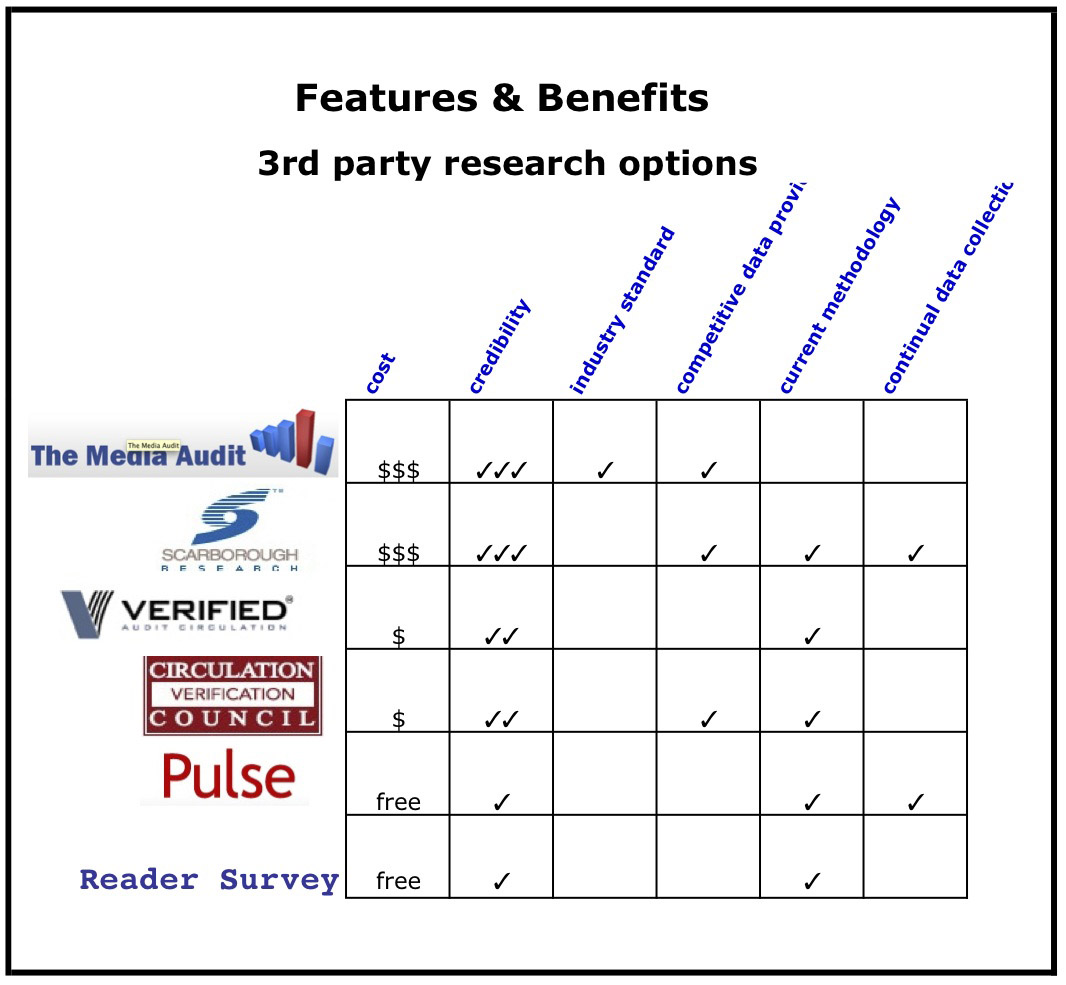

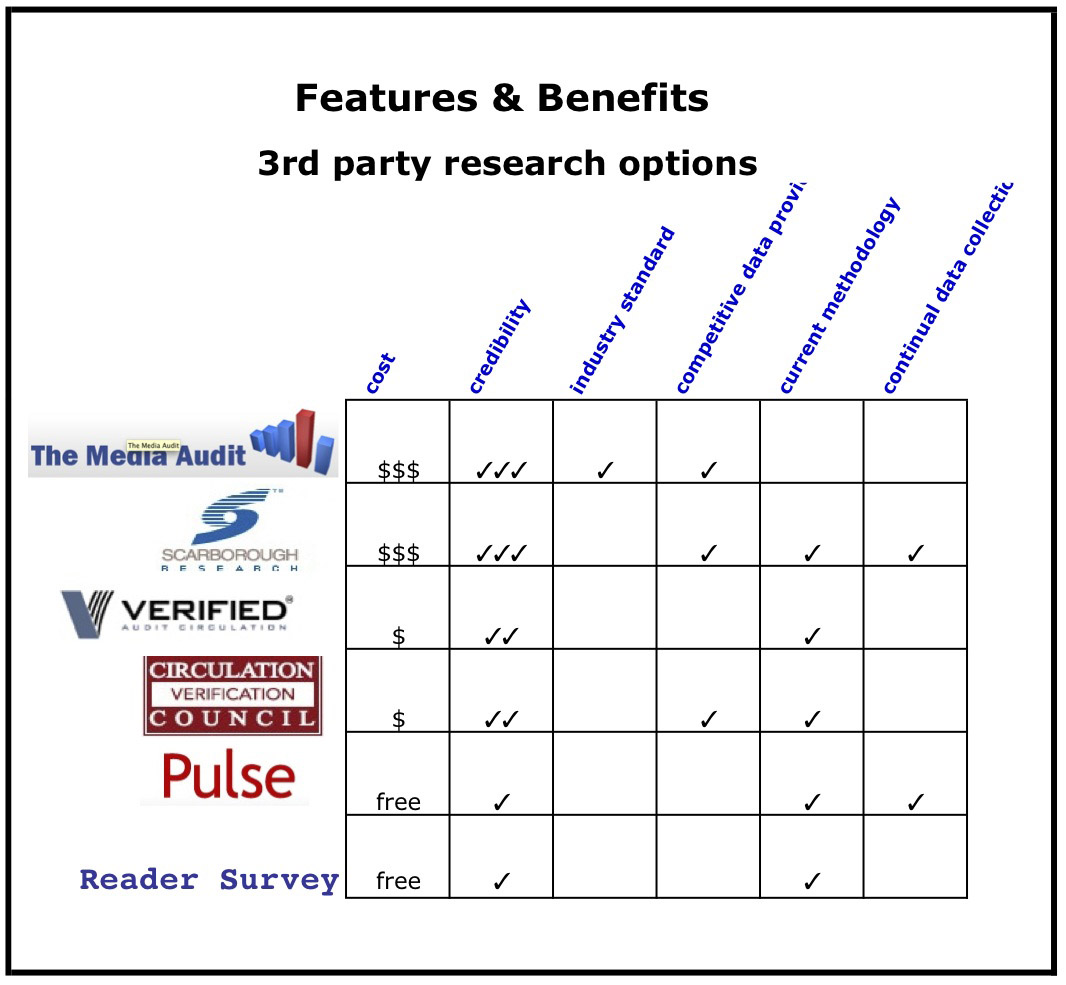

To help publishers wade through this challenge, we have been doing a little research of our own. Based on a history of advertiser requests, we strongly recommend all publishers acquire some form of readership research. The way we see it, publishers have three options for collecting and presenting readership data to potential advertisers, and each option comes with advantages and disadvantages; syndicated research, third-party research, and self-administered surveys.

SYNDICATED RESEARCH

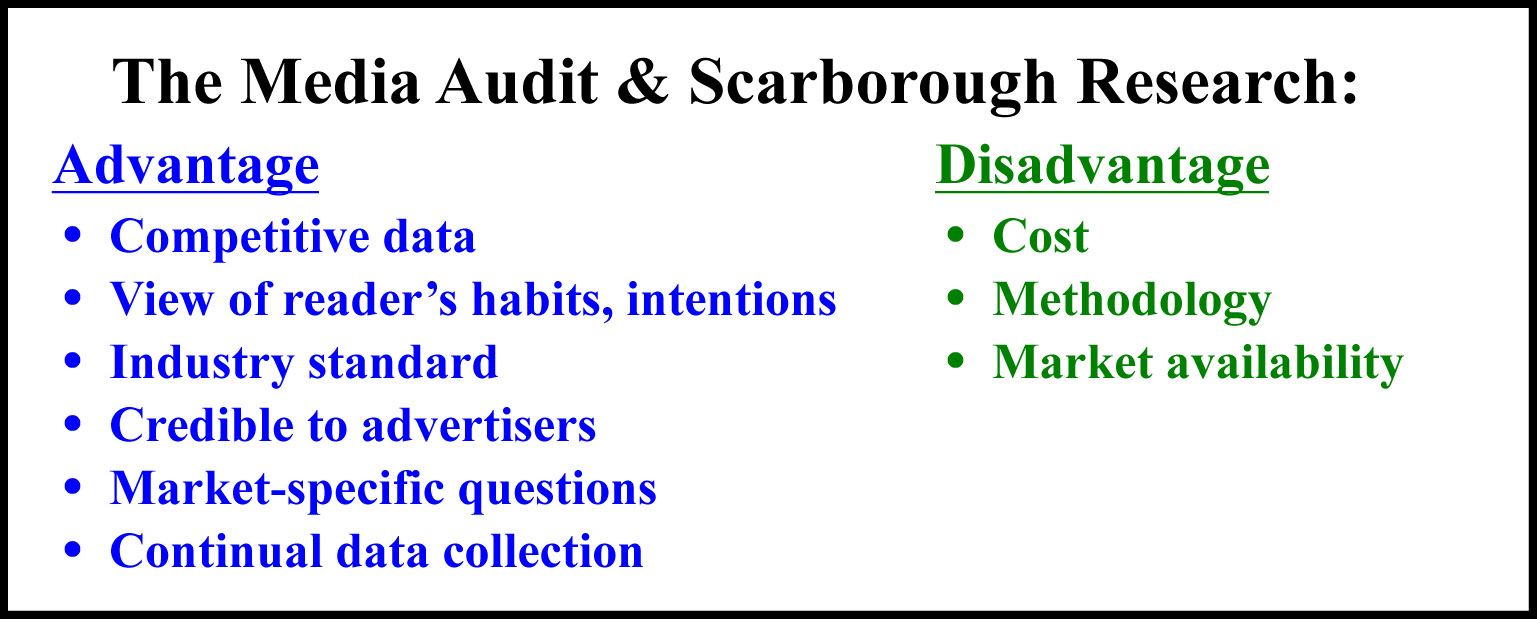

One choice is to subscribe to an industry standard syndicated study (The Media Audit and Scarborough Research). These are two highly recognizable syndicated research firms offering comprehensive local market studies for print publications.

Reader research is expensive, and some argue these two stalwarts (The Media Audit and Scarborough Research) do not accurately reflect the true readership of alt weeklies.

Some complain The Media Audit data is gathered through overly lengthy (36 min.) phone surveys that at best capture plenty of useful data from a consistent yet non-representative audience. This shortcoming is in part due to another complaint which is the lack of mobile phone surveys (mobile is not yet part of the methodology though several markets have been beta tested).

Scarborough Research also conducts phone interviews (16 min.) which are followed up with a self-administered survey. Written survey directions are sent via snail-mail (with “cash incentive”) and participants are directed to complete the survey online. Scarborough has also been testing mobile phone data gathering in a number of major markets but has not changed their methodology across-the-board.

The Media Audit (TMA) offers separate research studies for print and online readers, on both the local and national level. Visit their www.themediaaudit.com to learn more about the research and review their products. TMA claims to be “The most comprehensive media audience measurement and consumer intelligence in today’s changing marketplace.” TMA built their business on television, radio and newspapers and continue to have extensive depth within those media categories today.

TMA has been a research option for the alternative newsweekly industry for more than 25 years and has maintained an ongoing relationship with AWN for the last 15 years. Currently, 46 alt publications (A.A.N. members) are subscribing to their local syndicated research product. Some alt weekly publishers purchase the online research data too.

Scarborough Research offers a suite of services, from their Top-Tier Local Market Studies (researching 77 local markets, analyzing data such as market penetration and brand loyalty) to Scarborough Sports Marketing (demographics, shopping, and media information about local sports fans). Review their products and services at www.scarborough.com. Scarborough is noteworthy for their extensive number of consumer targets (1,800) and their research accreditation.

Scarborough built their business model for daily newspapers originally and continues to have that media group as a primary source in their data gathering process today. Scarborough has limited client penetration within the alt weekly industry. For a more in depth analysis of both syndicated research firms, see our side-by-side TMA vs. Scarborough blogpost earlier this year on this blog site.

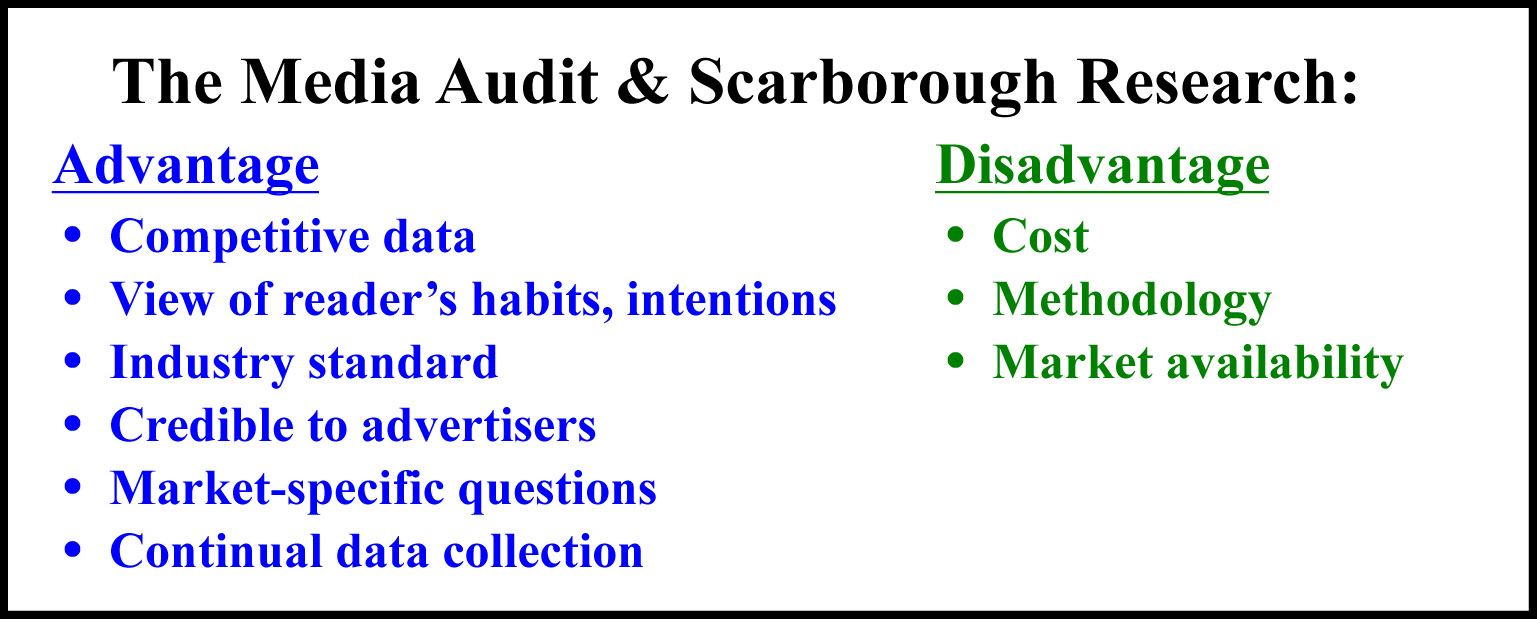

Here are the advantages and disadvantages (as we see them) of syndicated market studies:

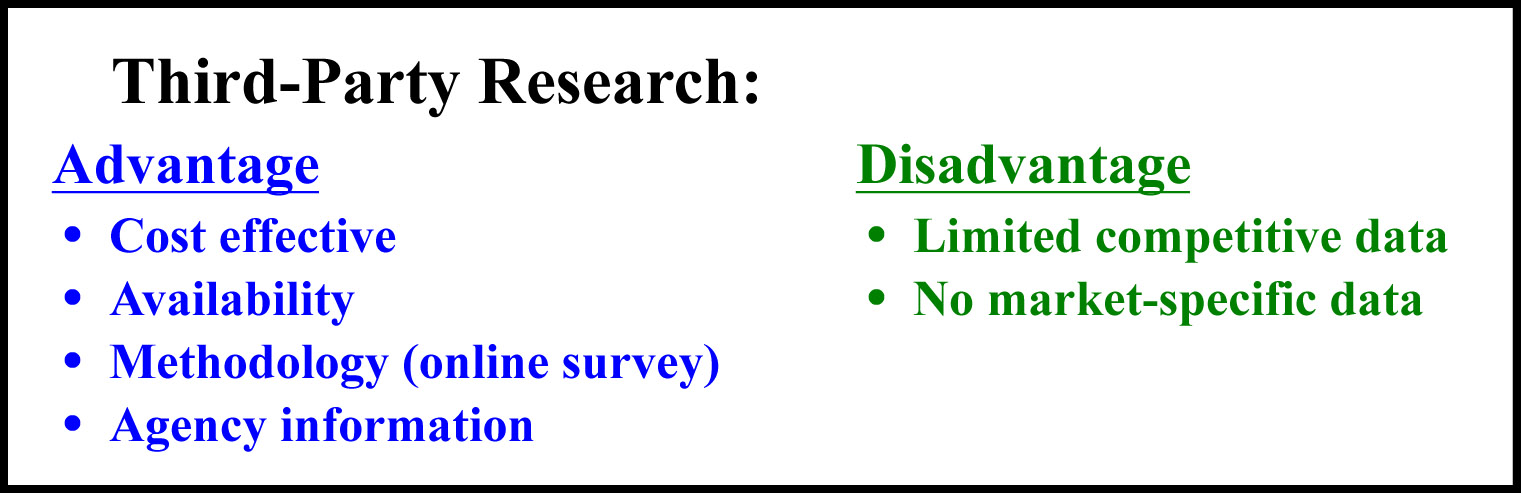

THIRD-PARTY MARKET STUDIES

Another option is for publishers to utilize third party research firms that will provide less comprehensive market-specific data, but offer top-line market and demographic information. We focused on two circulation audit firms (Verified Audit Circulation, and Circulation Verified Council) who provide reader research services, as well as Pulse Research, a research firm that publishes a regular consumer shopping survey. These options (while less comprehensive in terms of competitive data) are considerably less expensive than syndicated research studies, and may be a viable solution for publications in markets not covered by the larger syndicated research firms.

Verified Audit Circulation (VAC) has a history of providing circulation audits for a large number of alternative weeklies over the past 30 years. Alan Levy, VP of Sales & Marketing describes their research product. “In addition to our circulation audits, our readership surveys are mostly administered on-line. This is an extremely cost-effective way to gather audience demographics, audience reach and readership information. We provide a website link to the survey for publishers to give to readers and we tabulate the results. The report can stand-alone or be incorporated into circulation audit reports and the fee is in the $2K -$3K range.” The survey is ongoing, and the publications typically offer incentives for participation. Levy says they like to receive 300 “completes” to get a reasonable margin of error. More information can be found at www.verifiedaudit.com and download PDF research example.

Circulation Verified Council (CVC) also offers reader demographics, automatically included when subscribing to their circulation audit service. Annual CVC rates for weekly publications range from $1281 (0-10K circ) to $2401 (50-100K circ). Jim Kennedy, VP of Audit Services detailed CVC’s services, some of which include:

– Readership Demographics product. CVC circulation audits include an online & mobile readership study that reports reader age, income and education demographics in addition to reader’s planned purchases from over 30 retail & service categories.

– After every CVC audit we release a copy of your audit report and a certification letter to ten local advertisers chosen by you from your local area. Additionally, CVC is building a database list of regional and national media buyers in each state and local market that will be made available to subscribers.

Just a few AWN publications are currently subscribing to CVC auditing services; hopefully more will do so in the future which will automatically deliver a simple offering of demographics. For more information about CVC audits and reader demographics, visit http://cvcaudit.com.

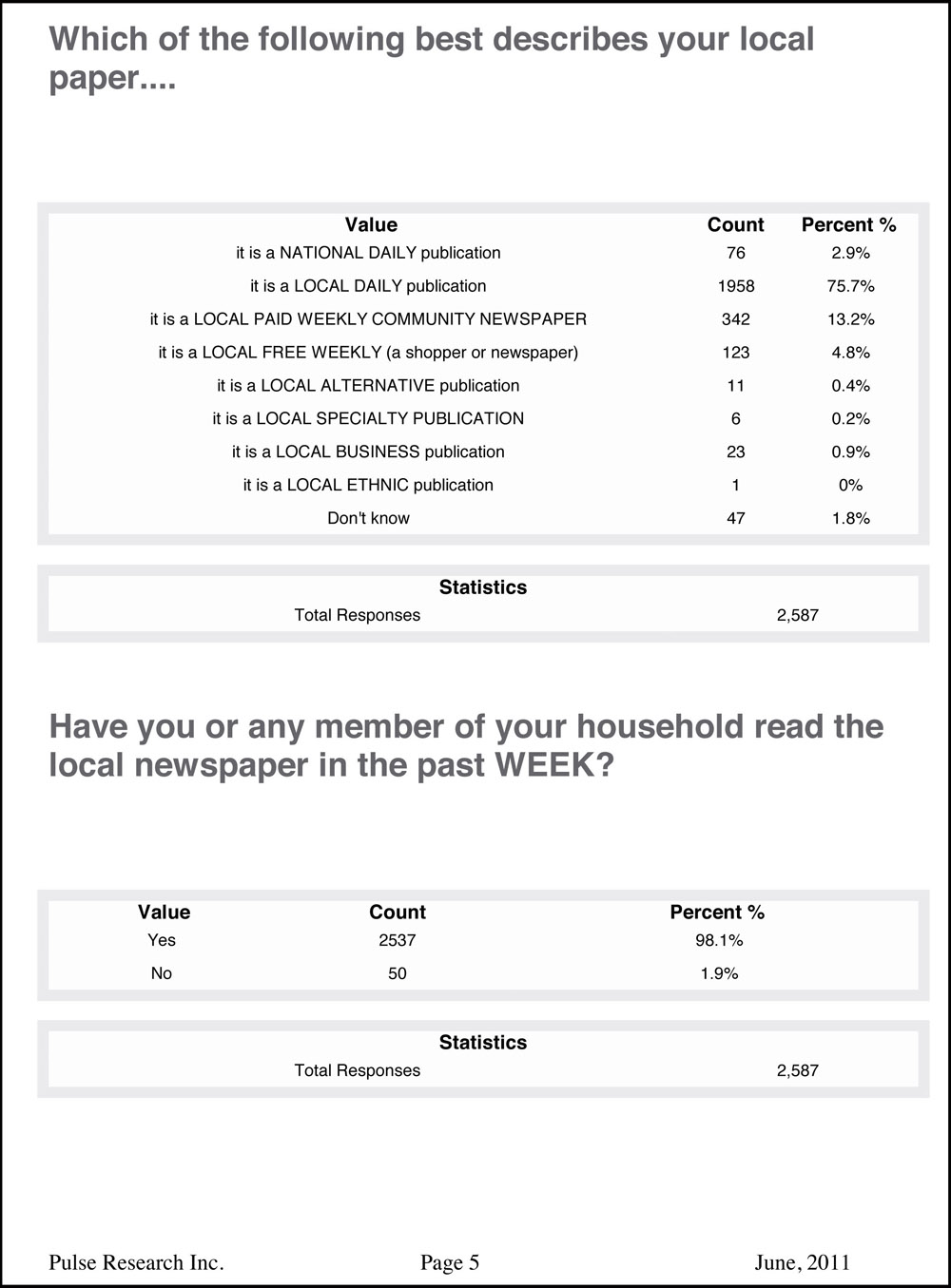

Pulse Research is “an ongoing consumer shopping survey” which details national household shopping. The data is free to publications that help to promote the site by placing a digital ad promoting the market survey.

From John Marling, President of Pulse Research, Inc., “Participation would be quite simple, AWN member publications would promote the Pulse of America survey in print and on their websites. In appreciation, AWN and member publications would receive a complimentary copy of the AWN respondent results. Pulse Research would provide the incentive, which for Q3 is a drawing for six months of FREE groceries.” While the data is essentially free, Pulse provides a service called AdSeller, which helps users make sense of the data, and creates clean and effective sales presentations. Publishers can choose to pay for this platform though it is not a requirement to be included in the research group.

Pulse has been known primarily for their research-based ad sales and marketing programs for daily & weekly newspapers. Although Pulse is new to AWN, we’ve been exploring this option along with the circulation audit companies as an umbrella solution for smaller publications and markets across the country.

For information about Pulse Research and their AdSeller product, visit: www.pulseresearch.com

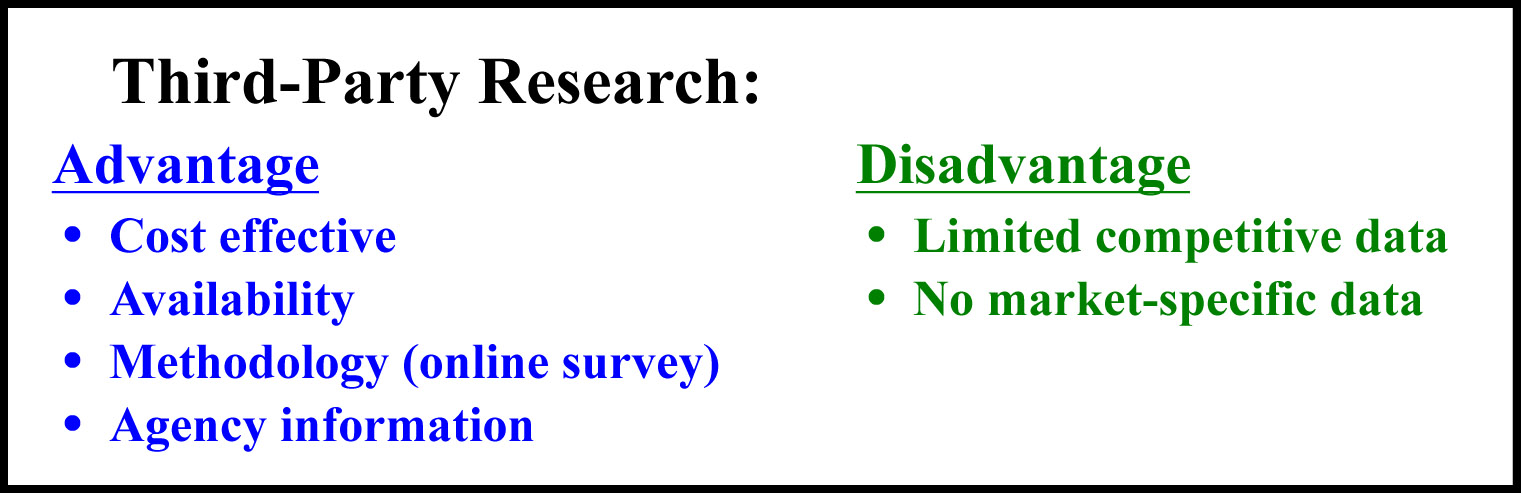

Here’s our view of the advantages and disadvantages of third-party research:

SELF-ADMINISTERED READER SURVEYS

The final option, publications can hire a research firm to survey their readers or conduct in-house reader surveys. With tools such as SurveyMonkey, Zoomerang, SurveyGizmo, and PollDaddy, online surveys are free, or nearly free. These can be effective tools for instant feedback and to take your readers’ pulse.

Some publications also partner with their local universities to conduct research, which in turn offer credible, scholarly market data (not to mention great opportunities for Grad students). This kind of research, however, usually is a one-time survey and it can take several months to receive the data. Also these surveys do not come with report writers, which help sales professionals present the information. These are academics, not ad sales folks.

Additionally, the data acquired from reader surveys only provides demographics and habits of people already reading the publication. The data is not compared to the general population data, which is traditionally Alt Weekly’s strongest selling point (e.g. Alt readers are more educated and more affluent than the general public).

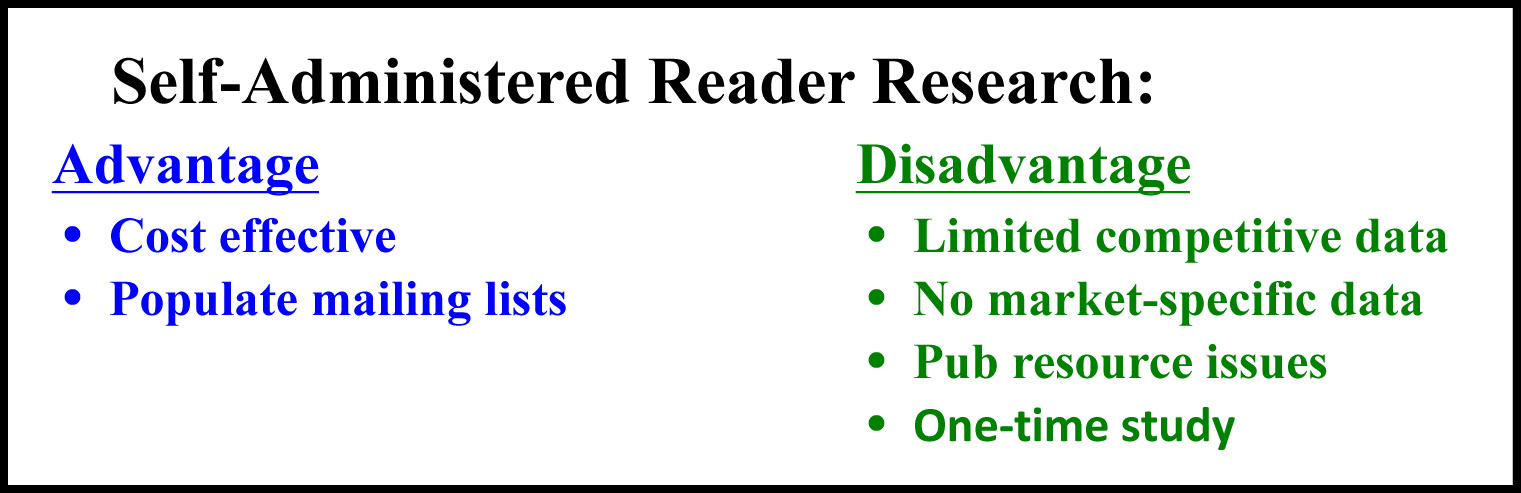

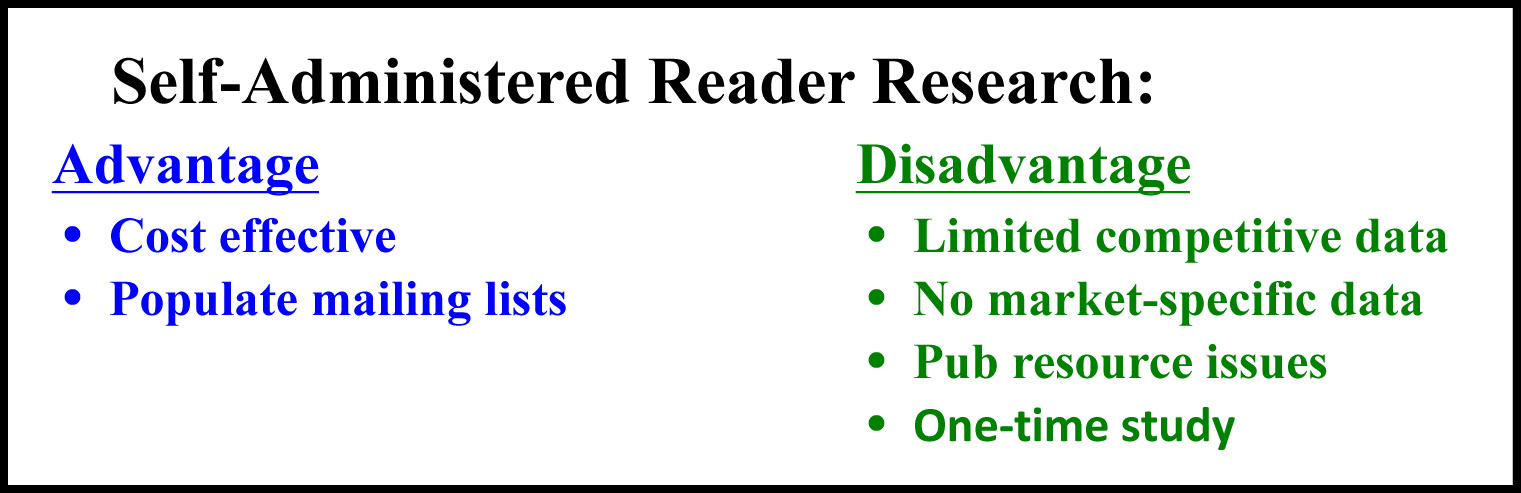

Here’s our view of the advantages and disadvantages of self-administered reader research:

SUMMARY

Publications need to know about their readers. Readership data can be used for planning special sections, selecting cover art, planning/designing editorial content and distribution.

More importantly, readership data helps publications sell advertising. We all know our readers are educated, affluent, and active – collecting data from (and about) our readers allows us to prove to the advertisers what we may already know. By purchasing readership information, you are arming your sales team with essential tools they’ll need to survive in the sales arena.

By 2016, the local advertising pie will continue to diminish for legacy media. Besides the current trends with most SMBs moving to newer, digitally-based marketing forms, he suggests the current generational divide will slowly erode with parents’ handing off ownership to their children which will only accelerate the move to newer media models.

By 2016, the local advertising pie will continue to diminish for legacy media. Besides the current trends with most SMBs moving to newer, digitally-based marketing forms, he suggests the current generational divide will slowly erode with parents’ handing off ownership to their children which will only accelerate the move to newer media models.

Our audience of local influencers is a marketer’s dream: educated, engaged, conscious and affluent city dwellers.

Our audience of local influencers is a marketer’s dream: educated, engaged, conscious and affluent city dwellers.